Blog

Displaying items by tag: mobile operators

The 5G operator business model challenge

The 5G operator business model challenge

In my day to day work for clients such as GCF I am often in touch with stakeholders from across the mobile industry and (increasingly) with industry leaders in other industry sectors who are looking to capitalise on 5G technologies. The topic of 5G business models is never far from my mind in these discussions so rather than store this all up, I thought I would start to blog about it. I’ll aim to post regularly. Please use the comments section to let me know what you think and if you have any questions.

What are the key challenges facing the mobile industry?

In November 2019 I led a 5G conference in Dubai titled ‘Building a 5G World’. A key theme of the conference was what use cases and businesses would 5G enable and how should industry actors (in particular operators) go about developing these use cases and businesses? To lay the ground for the discussion I summarised the challenge operators face as follows:

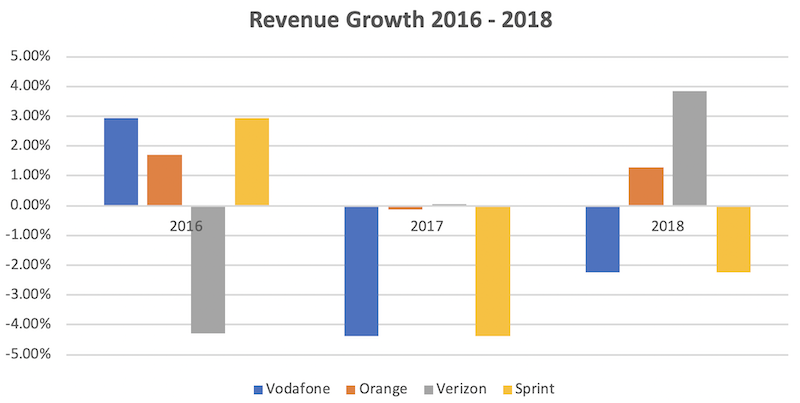

Mobile operators are mature businesses with low sales growth

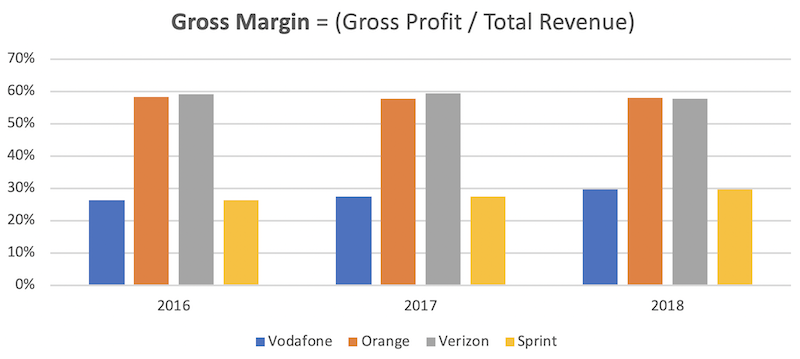

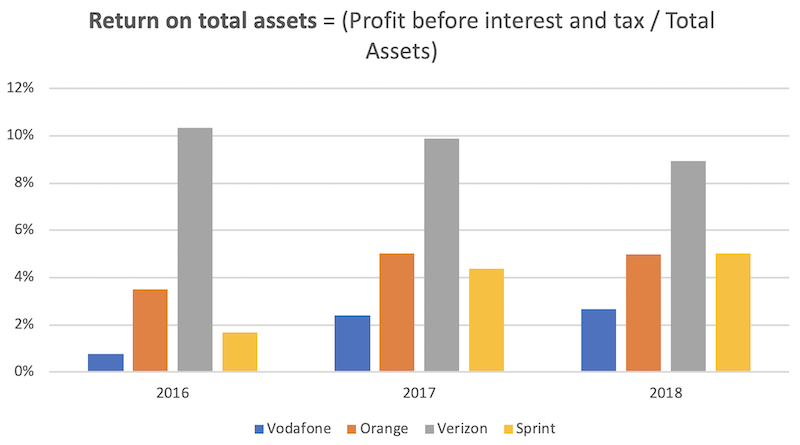

Mobile operators are profitable but are capital-intensive businesses – most make low returns.

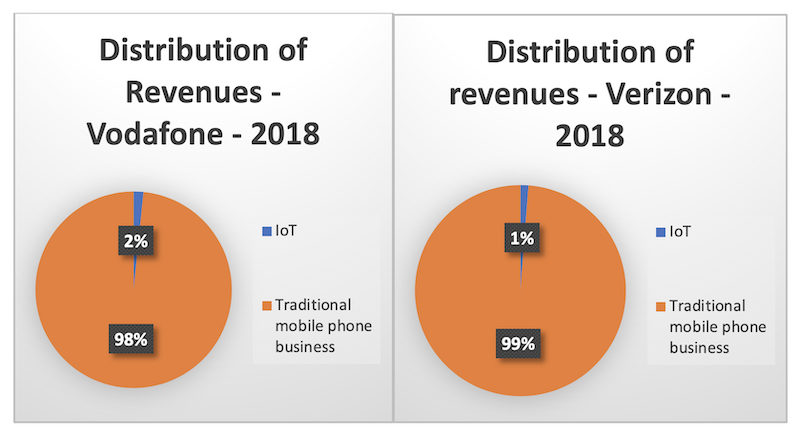

Making money out of IoT is a major challenge

Why is it challenging to make money ‘beyond smartphones’?

There are many reasons why operators are finding it challenging to make money out of IoT and (by extension) 5G services beyond mobile service (think connected and autonomous vehicles, connected/smart manufacturing, smart cities etc). There are challenges around how to identify and develop ideas into new businesses taking account of competitive pressures; how to organise the business in order to serve these new markets; getting the technology roadmap right etc. I will explore each of these issues in more detail in future posts, but the key point is that there is a long way to go to solve these issues – and it is an interesting question as to how successful operators can be in deriving substantial new revenues from the digital transformation of society.

How can operators improve their IoT / 5G businesses?

There are lots of potential ways – I'll explore these more in future posts.

- Prioritise industry sectors / markets by their propensity to use and deploy 5G and IoT tech. When will there be a need? Why is there a need? What bottlenecks exist and why?

- Understand the evolving competitive environment in potential markets. What markets are attractive, which ones less so? How should the organisation develop its capabilities to best address the emerging environment? Who should operators work/partner with and why?

I’ll explore these issues further in future posts.

Driving growth in IoT

Next week I'll be hosting GCF's 5G MENA conference - an event that I've organised on behalf of client, Global Certification Forum (GCF), for the last 3 years. Normally held in Dubai, this year it's online. It's proving to be a popular event with a very wide and diverse range of speakers from across the mobile industry. We'll be talking about 5G and its path forward and how related technologies such as AI, IoT and cloud can take advantage of 5G to help deliver new services. It's all exciting stuff - which is great. However in reviewing the state of the industry I came across a 2014 forecast from GSMA Intelligence 'Cellular M2M forecasts from 2010 - 2020'. It's an interesting read - and their forecast (if you believe the numbers from the latest Ericsson Mobility report) of just under 2 billion cellular IoT connections by 2020 turned out to be relatively on the ball. They also identify many potential initiatives that could aid growth (e.g. standardisation, government driven programs for e.g. smart meters, e-Call for (European) vehicles, lower cost modules). One of the growth levers they identify is 'new operator business models' - but unfortunately this is the least developed part of the report. Although there is reference to creating partnerships and the need to change operating models to serve business customers (and B2C and B2B2C) - there is little in the way of how to actually discover new use cases that can be turned into viable businesses - what objectives operators could set and what strategies could be realistically employed to help meet these objectives. For example - what are the challenges in each sector (regulations, fragmentation, competition, other technologies)? How can these challenges be overcome? How to organise a structured approach to finding and developing new opportunities?

I'm not seeking to criticise a historical piece of analysis (the forecast contained within it is indeed, relatively accurate) - but I am left wondering if the industry - and in particular mobile operators are really capitalising on IoT as much as they could. When I see revenue figures of IoT contributing 1% of overall revenues (see my previous post) - it makes me wonder. There's a lot of upside to be had if the right objectives are identified and appropriate strategies adopted.